Smartasset retirement tax calculator

Excise taxes on alcohol in Nevada depend on the alcoholic content of the beverage being sold. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

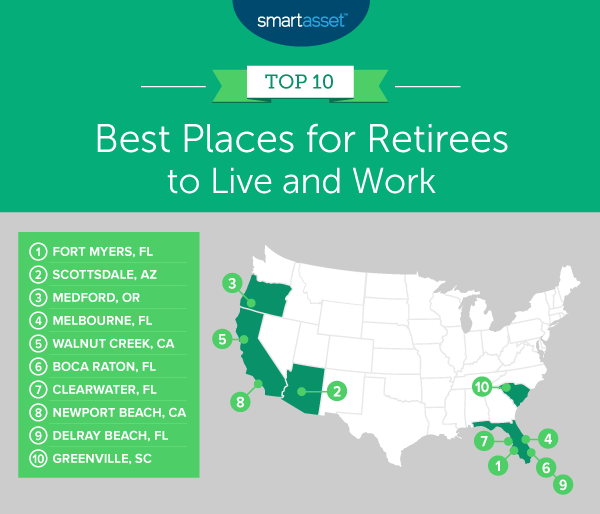

The Best Places To Retire In The U S In 2020 Smartasset

Washington State has no income tax.

. There is no state income tax in Texas which means Social Security retirement benefits and all other types of retirement income are tax-free. Ramsey County Minnesota Property Tax Calculator. A financial advisor in Minnesota can help you understand how these taxes fit into your overall financial goals.

If you havent received a bill by March 1 and your mortgage lender hasnt. Securities and Exchange. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

What is the Colorado senior property tax exemption. This means Social Security pensions and other forms of retirement income are all tax-free. The low tax rates in Texas are another reason to retire in the Lone Star State.

Your household income location filing status and number of personal exemptions. Minnesota Property Tax Calculator. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

Capital Gains Taxes on Property. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Nevada Property Tax Rates.

The exemption is equal to 50 of the first 200000 in home value. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. SmartAsset Advisors LLC SmartAsset a wholly owned subsidiary of Financial Insight Technology is registered with the US.

That means income from Social Security pensions and retirement accounts is all tax-free in Washington. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. How Income Taxes Are Calculated.

Overview of Washington Retirement Tax Friendliness. There is no state income tax in South Dakota. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

Wine is taxed at a rate of 70 cents per gallon beer at a rate of 16 cents per gallon and liquor at a rate of 360 per gallon. Of special interest to retirees are generally issues such as whether Social Security benefits are taxable at the state level what property taxes will be levied and how retirement account and pension. Overview of South Dakota Retirement Tax Friendliness.

Our Illinois retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income. However many Maryland homeowners pay at least 3515 in property taxes per year as the states median home value is quite high. Your household income location filing status and number of personal exemptions.

Retirement estate planning and more to make sure you are preparing for the future. Sales tax still applies in addition to those excise tax rates. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. In the meantime you can view your property tax bill online by visiting kingcountygov and entering your tax account number for your real or personal property you can find this number on your Assessors Valuation Change Notice or an older property tax statement. The average effective property tax rate in the state is 106.

How Income Taxes Are Calculated. Thus even if home values increase by 10 property taxes will increase by no more than 3. So for example if a home is worth 100000 50000 of that will be exempt from property tax.

Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. The senior property tax exemption is a form of property tax relief available to seniors who own and occupy their home in Colorado. That can mean thousands of dollars a year in tax savings as compared with other states.

To make matters worse rates in most major cities reach this limit. Texas Sales Tax. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too.

Our New Hampshire retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income. Nevadas tax abatement law protects homeowners from sudden spikes in their property taxes. To find a financial advisor who serves your area try our free online matching tool.

Maryland property tax rates are close to average although taxes paid can be very expensive because of the states high home values. A good capital gains calculator like ours takes both federal and state taxation into account. Overview of Retirement Tax Friendliness Retirees have specific financial concerns and some states have taxes that are friendlier to those needs.

The Minnesota state income tax is based on four tax. SmartAsset Advisors LLC SmartAsset a wholly owned subsidiary of Financial Insight Technology is registered with the US. There are numerous tax districts within every Nevada.

How high are property taxes in Maryland. SmartAssets free and interactive tools help you make smarter decisions on home buying refinance retirement life insurance taxes investing personal loans and more. The law limits increases in property taxes on primary residences to 3 per year.

New Hampshire doesnt tax income but does tax dividends and interest. Sales taxes are quite low in South Dakota and though property taxes are somewhat high low-income seniors can offset those costs. Your household income location filing status and number of personal exemptions.

Rates range from 335 to 875. Use SmartAssets property tax calculator by entering your location and assessed home value to find out your property tax rate and total tax payment. Sales tax rates are quite high and property tax rates are about average.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Nevada Alcohol Tax.

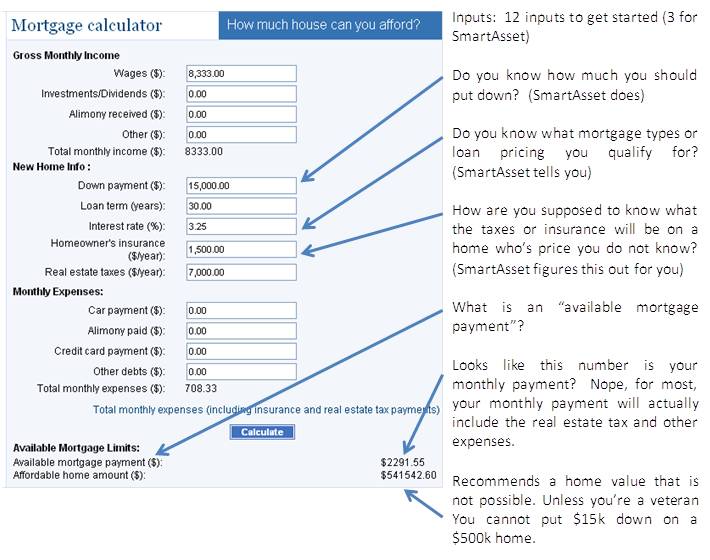

Smartasset The Financial Calculator Killer Smartasset Com

What Is A Tax Exemption Smartasset

Will Medical Bills Drain Your Retirement Income

Smartasset Launches Live Connections A New Client Acquisition Program For Financial Advisors With A 100 Contact Rate Business Wire

You Can Make This Much Retirement Income Without Paying Taxes

Smartasset Review 2022 Features How It Works Pros Cons

What It Takes To Be In The 1 By State 2022 Study Smartasset

How Retirees Can Avoid Taxes On Lump Sum Pension Payouts

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

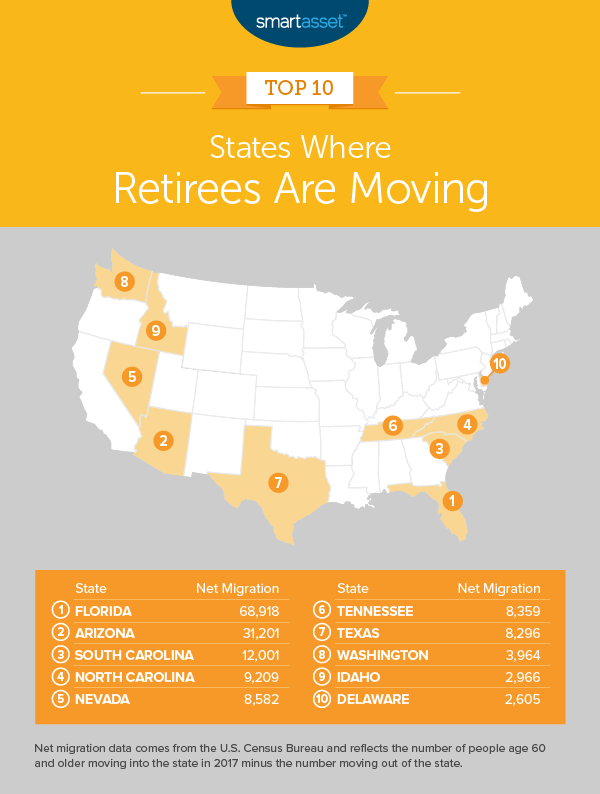

Where Retirees Are Moving 2019 Edition Smartasset

Free Income Tax Calculators The Best In The Usa

Best States For An Early Retirement 2019 Edition Smartadvisor Match

Pennsylvania Income Tax Calculator Smartasset

2022 Smartasset Review Pros Cons More Benzinga

Vanguard This Easy Change Can Help Investors Save Retirement Income

Smartasset Adjusts Timeline On Public Advisor Profiles You Ll Have On Wealth Management

The 20 Best Online Tools To Calculate Your Income Taxes In 2021